Description

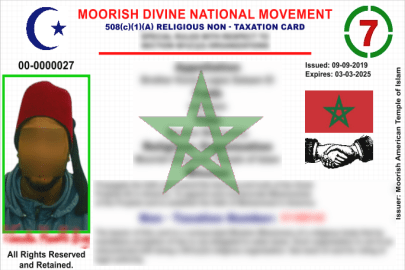

Introduction to 508(c)(1)(a) Religious Non-Taxation

The 508(c)(1)(a) provision under Title 26 of the United States Code offers a distinctive approach to federal income tax exemption for certain religious organizations. Unlike the more widely recognized 501(c)(3) status, which necessitates a formal application and adherence to specific regulatory requirements, the 508(c)(1)(a) designation automatically bestows tax-exempt status upon qualifying religious entities. This provision underscores the importance of religious freedom by alleviating the administrative burden for faith-based organizations, allowing them to focus on their spiritual missions.

One of the key distinctions of the 508(c)(1)(a) status is its inherent nature. Religious organizations that qualify under this provision are not obligated to file Form 1023 for recognition of exemption. Instead, their tax-exempt status is presumed, provided they meet certain criteria outlined by the Internal Revenue Service (IRS). This streamlined process can be particularly beneficial for smaller or newly established religious groups that may lack the resources to navigate the complex application procedures required for 501(c)(3) status.

The significance of 508(c)(1)(a) extends beyond mere administrative convenience. It embodies a fundamental respect for the autonomy of religious institutions, allowing them to operate without undue interference from the federal government. However, it is crucial for organizations to understand the specific requirements and limitations associated with this provision to ensure compliance and maintain their tax-exempt status. For example, while 508(c)(1)(a) organizations are exempt from federal income tax, they must still adhere to basic IRS guidelines, including prohibitions against political campaign activities and substantial lobbying efforts.

This introductory overview sets the stage for a comprehensive exploration of 508(c)(1)(a) religious non-taxation. Subsequent sections will delve into the legal intricacies, operational considerations, and practical implications of this unique tax-exempt status, providing faith-based organizations with the knowledge and tools necessary to navigate this specialized area of tax law effectively.

Legal Framework of Title 26 United States Code 508(c)(1)(a)

Title 26 United States Code 508(c)(1)(a) is a notable provision within the Internal Revenue Code that plays a crucial role in the tax treatment of religious organizations. This specific section exempts certain faith-based organizations from the standard requirement to apply for formal recognition of tax-exempt status. The legislative history of 508(c)(1)(a) underscores Congress’s intent to streamline the compliance process for religious entities, acknowledging their unique position and societal contributions.

To qualify under 508(c)(1)(a), a religious organization must meet specific criteria that differentiate it from other nonprofit entities. Firstly, the organization must be inherently religious in nature, focusing primarily on the practice, promotion, or teaching of religious beliefs. Additionally, the entity should operate on a not-for-profit basis, ensuring that any income generated is solely used to further its religious mission and not distributed to private individuals or shareholders.

The formal process for a religious organization to obtain 508(c)(1)(a) status is notably streamlined. Unlike other non-profits that must file Form 1023 or 1024 with the IRS to apply for tax-exemption under sections 501(c)(3) or 501(c)(4), religious organizations under 508(c)(1)(a) are automatically considered tax-exempt without needing to file these forms. However, it is advisable for such organizations to maintain thorough records and documentation to substantiate their status should the need arise.

When comparing 508(c)(1)(a) with other tax code provisions applicable to non-profits, one significant difference is the reduced administrative burden. Non-religious non-profits must adhere to more complex application and reporting requirements to achieve and maintain their tax-exempt status. In contrast, the streamlined approach provided by 508(c)(1)(a) for religious organizations reflects a legislative recognition of their unique role and the desire to facilitate their operations without undue bureaucratic impediments.

In summary, Title 26 United States Code 508(c)(1)(a) offers a simplified and advantageous route for religious organizations seeking tax-exempt status. By understanding the legislative framework, qualifying criteria, and procedural differences, faith-based entities can better navigate the regulatory landscape to fulfill their missions effectively.

Differences Between 508(c)(1)(a) and 501(c)(3) Status

The distinctions between 508(c)(1)(a) and 501(c)(3) statuses are significant for faith-based organizations, particularly regarding application processes, reporting requirements, and tax benefits. Understanding these differences can help organizations decide which status best suits their mission and operational needs.

Firstly, the application process differs markedly between the two. A 501(c)(3) organization must file Form 1023 or Form 1023-EZ with the IRS to obtain tax-exempt status. This process requires detailed information about the organization’s structure, governance, and financials. In contrast, 508(c)(1)(a) status is automatically conferred to churches and their integrated auxiliaries. No formal application is required, simplifying the process for many faith-based groups.

Secondly, reporting requirements vary. 501(c)(3) organizations are obligated to file an annual Form 990, which provides the IRS with comprehensive financial and operational data. This transparency ensures accountability but can be burdensome for smaller organizations. Conversely, organizations with 508(c)(1)(a) status are generally exempt from filing Form 990. This exemption reduces administrative burdens and allows these organizations to focus more on their core religious activities.

Tax benefits also differ between the two statuses. Both 508(c)(1)(a) and 501(c)(3) organizations receive federal income tax exemptions and can offer tax-deductible donations to their contributors. However, 508(c)(1)(a) organizations enjoy additional protections under the First Amendment, which can shield them from certain regulatory and legal constraints that may apply to 501(c)(3) entities.

For example, a small church with limited administrative capacity might find the streamlined process and reduced reporting requirements of 508(c)(1)(a) status more advantageous. In contrast, a larger faith-based non-profit involved in extensive social services might prefer the structured framework and broader public transparency offered by 501(c)(3) status.

Ultimately, the choice between 508(c)(1)(a) and 501(c)(3) status should be guided by an organization’s specific needs, goals, and resources. A thorough understanding of these differences is crucial for any faith-based organization seeking to optimize its operational effectiveness and compliance with federal regulations.

Benefits of 508(c)(1)(a) Status for Faith-Based Organizations

Faith-based organizations that obtain 508(c)(1)(a) status enjoy a multitude of benefits, significantly enhancing their ability to fulfill their missions. One of the most prominent advantages is the exemption from federal income tax. This exemption allows religious organizations to allocate more resources towards their core activities, such as community outreach, charitable programs, and spiritual services, without the financial burden of federal taxes.

Another significant benefit is the reduction in administrative burdens. Unlike 501(c)(3) organizations, 508(c)(1)(a) entities are not required to file annual IRS Form 990. This reduction in paperwork not only saves valuable time and resources but also helps maintain the privacy of the organization’s financial information. As a result, faith-based organizations can focus more on their mission-driven initiatives rather than on administrative compliance.

Operational flexibility is also a key advantage of 508(c)(1)(a) status. These organizations are granted greater freedom in their activities compared to their 501(c)(3) counterparts. For instance, 508(c)(1)(a) entities are not subject to the same restrictions on political activities, allowing them to advocate for issues aligned with their religious beliefs without jeopardizing their tax-exempt status. This flexibility can be crucial in addressing social and moral issues that are central to their mission.

The cumulative effect of these benefits is that faith-based organizations can operate more effectively and efficiently. With more financial resources, reduced administrative overhead, and greater operational freedom, these organizations are better positioned to serve their communities and promote their spiritual and charitable goals. In essence, obtaining 508(c)(1)(a) status empowers religious entities to more fully realize their vision and mission, ultimately making a greater impact in the world.

Application Process

Unlike other tax-exempt statuses, 508(c)(1)(a) status does not require a formal application or a determination letter from the IRS. Instead, the organization must ensure that it meets and continues to meet the requirements set forth under this classification. However, maintaining thorough records and documentation is crucial for compliance and future verification purposes.

Practical Tips and Common Pitfalls

Organizations should be meticulous in maintaining records and documentation that support their religious purpose and activities. Regular reviews of these documents can ensure ongoing compliance. Common pitfalls include vague or inconsistent descriptions of religious activities in foundational documents, and failure to maintain adequate records. To avoid these issues, organizations may consider seeking guidance from legal experts specialized in religious non-taxation matters.

By following these steps and paying careful attention to detail, religious organizations can effectively navigate the process of obtaining 508(c)(1)(a) status, thereby securing their ability to operate with the associated tax benefits and autonomy.

Case Studies of Faith-Based Organizations Utilizing 508(c)(1)(a)

The 508(c)(1)(a) status offers significant advantages for faith-based organizations, providing them with financial relief and greater autonomy. Various religious traditions have successfully leveraged this provision, demonstrating its wide-reaching applicability and benefits. Below, we highlight a few case studies from diverse religious backgrounds.

One notable example is a Christian church in Texas, which was able to secure 508(c)(1)(a) status to enhance its community outreach programs. This status allowed the church to allocate more resources towards its food pantry and educational initiatives without the burden of federal income tax. The increased financial flexibility significantly amplified their impact, enabling them to serve a larger segment of the community.

In the Islamic community, a mosque in California also benefited from 508(c)(1)(a) status. The mosque utilized the tax-exempt status to fund various cultural and religious activities, including interfaith dialogues and youth leadership programs. The financial savings were redirected towards expanding their facilities and supporting more comprehensive services for the local Muslim population.

Wiccan and Santeria groups have similarly found 508(c)(1)(a) advantageous. A Wiccan coven in Oregon, for instance, used the tax-exempt status to preserve sacred land and host educational events about their spiritual practices. Meanwhile, a Santeria community in Florida capitalized on the status to maintain their cultural heritage and conduct ceremonies without financial strain.

Jainism and Sikhism organizations have also reaped the benefits of 508(c)(1)(a). A Jain temple in New Jersey leveraged the status to promote non-violence and environmental sustainability initiatives. The temple’s educational programs on Jain philosophy saw increased participation due to the available funds. Similarly, a Sikh Gurdwara in New York used the exemption to support langar (community kitchen) services, offering free meals to anyone in need, reflecting the core Sikh value of selfless service.

These case studies illustrate the broad applicability and profound impact of 508(c)(1)(a) status across various faith-based organizations. By alleviating financial burdens, this provision empowers religious groups to focus on their spiritual missions and community services, ultimately fostering a more inclusive and supportive society.

Common Challenges and Solutions

Faith-based organizations seeking to obtain and maintain 508(c)(1)(a) status often encounter several challenges. Understanding these challenges and knowing how to address them can make the process smoother and more efficient.

One of the primary legal hurdles is ensuring compliance with the intricate requirements set forth by the Internal Revenue Service (IRS). Unlike the more commonly known 501(c)(3) status, 508(c)(1)(a) status is automatically conferred to churches and certain other religious organizations. However, ambiguities in defining what constitutes a “church” or a “religious organization” can lead to complications. To mitigate this, organizations should maintain comprehensive documentation of their religious activities, governance structure, and financial records. Consulting with a legal expert who specializes in nonprofit law can provide valuable guidance to navigate these complexities.

Administrative issues also pose significant challenges. Faith-based organizations must adhere to stringent record-keeping and reporting standards. This includes maintaining accurate financial statements, minutes of board meetings, and other pertinent records. Failure to do so can result in the revocation of their 508(c)(1)(a) status. Implementing robust administrative practices, utilizing specialized accounting software, and appointing experienced personnel for these tasks can help ensure compliance with these requirements.

Potential conflicts with other regulatory requirements can also arise. For example, faith-based organizations must comply with state and local regulations, which can sometimes conflict with federal requirements. Staying informed about the latest legal developments and seeking advice from legal professionals can help organizations navigate these conflicts effectively. Additionally, forming alliances with other faith-based organizations can provide a support network for sharing best practices and resources.

To overcome these obstacles, organizations can leverage various resources. The IRS provides detailed guidelines and publications to assist religious organizations in understanding their obligations. Additionally, nonprofit associations offer workshops, webinars, and other educational resources tailored to faith-based organizations. Engaging in continuous education and seeking expert advice are crucial steps in maintaining 508(c)(1)(a) status successfully.

Conclusion: The Future of 508(c)(1)(a) and Faith-Based Organizations

In summary, the 508(c)(1)(a) status remains a pivotal provision for faith-based organizations in the United States, offering crucial tax exemptions that facilitate their operations and outreach efforts. Throughout this guide, we have explored the historical context, legal framework, and practical implications of the 508(c)(1)(a) designation, underscoring its significance for religious entities striving to maintain financial and operational autonomy.

Looking ahead, the future of 508(c)(1)(a) status will likely be shaped by evolving legislative landscapes and societal trends. Potential changes in tax laws and regulations could impact the scope and application of this provision, necessitating vigilance and adaptability among faith-based organizations. Advocacy and informed participation in public discourse will be essential to safeguard the interests of these entities and ensure that their unique needs are addressed in any legislative reforms.

Moreover, trends in religious non-taxation may reflect broader shifts in societal attitudes towards religion and its role in public life. As the religious landscape in the United States becomes increasingly diverse, it is imperative that the 508(c)(1)(a) provision continues to accommodate a wide array of faith-based traditions and practices. This inclusivity will support the vibrant mosaic of religious expression that characterizes the nation.

The ongoing importance of the 508(c)(1)(a) provision cannot be overstated. It enables faith-based organizations to focus on their core missions—be it spiritual guidance, community service, or charitable endeavors—without the burden of onerous tax obligations. As these organizations navigate the complexities of modern governance and societal expectations, the 508(c)(1)(a) status will remain a cornerstone of their operational framework, ensuring their ability to contribute positively to society.

In closing, faith-based organizations should remain proactive in understanding and leveraging the benefits of the 508(c)(1)(a) status. By staying informed and engaged, these entities can continue to thrive and make meaningful impacts within their communities, upholding the rich tradition of religious non-taxation in the United States.

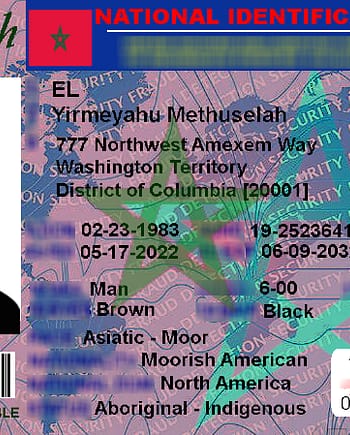

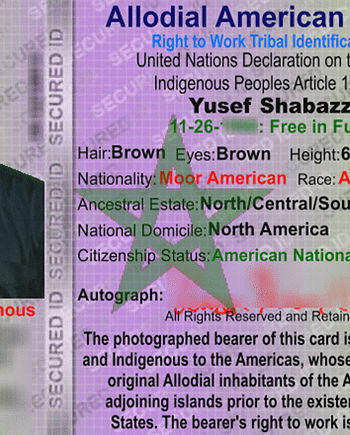

Discover more from Moorish Nationality Card Services

Subscribe to get the latest posts sent to your email.